by Scott Emick

3/3/25

Todays weekly charts:

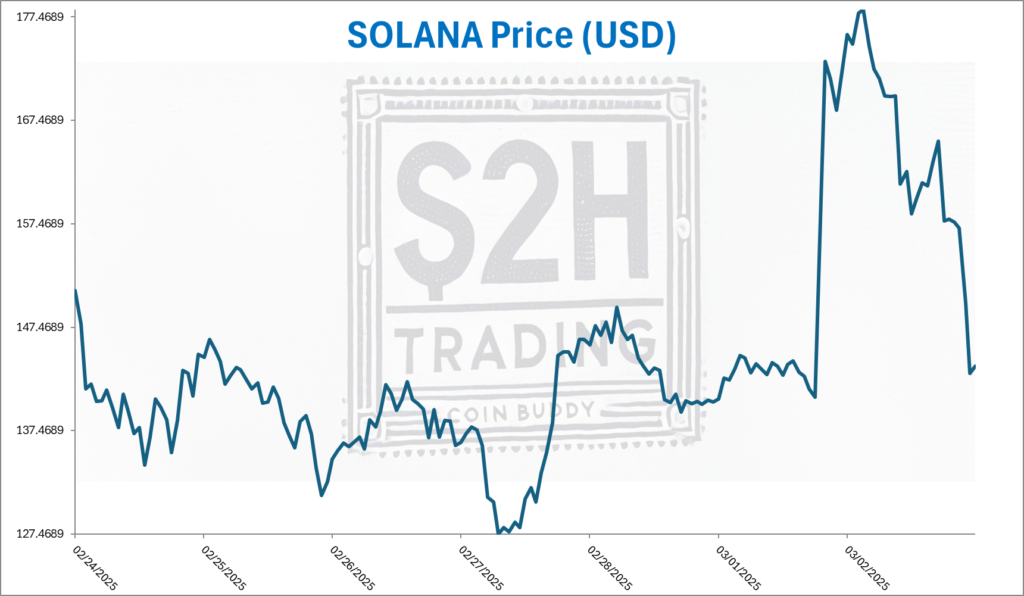

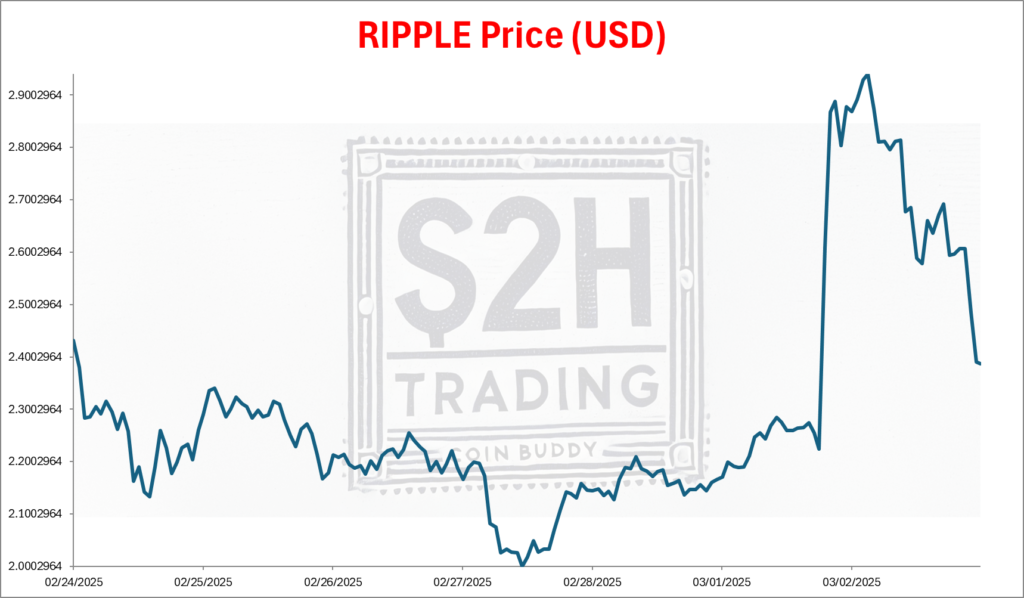

Yesterday’s charts that made many so happy were simply a Dead Cat Bouncing. This is a pattern I’ve observed many times in a bear Market. After a large price correction (crash), those who are buying the dip and other investors who just waited for volatility to end all buy in a short time and drive the price back up. Most of the time not all the way to previous highs. I was very impressed at this instance I almost thought maybe the bear market could have been over. But my intuition told me it probably wasn’t.

It is important to know Dead Cat Bouncing because let’s say you NEED to sell and there has just been a crash. One strategy might be to wait for the rebound (Dead Cat Bouncing) and sell then.

A dead cat bounce in trading refers to a temporary recovery or small rally in a declining asset price, followed by a continuation of the downward trend. It happens when a heavily declining asset experiences a brief rebound due to short-term buying, short covering, or market overreaction, but the overall bearish trend remains intact.

Characteristics of a Dead Cat Bounce:

1. Temporary Rebound – Prices rise briefly after a sharp decline.

2. False Hope – Some traders may mistake it for a trend reversal.

3. Continuation of Decline – The price resumes its downward trajectory after the bounce.

4. Occurs in Bear Markets – Common in downtrends when investors try to “buy the dip” or when short sellers take profits.

Why is it Called a “Dead Cat Bounce”?

The term is derived from the idea that even a dead cat will bounce if it falls from a great height—implying that the bounce is not a sign of recovery but rather a temporary reflex before further decline.

Example:

• A stock falls from $100 to $50.

• It then rises to $60 over a short period.

• Afterward, it drops further to $40 or lower.

How to Identify a Dead Cat Bounce:

• Look for low trading volume during the bounce.

• Check if the bounce lacks fundamental reasons for a recovery.

• Observe if the price fails to break resistance levels before resuming its decline.