Here’s a comprehensive weekly update on Bitcoin (BTC), Monero (XMR), Solana (SOL), and Ripple (XRP) as of Friday, April 18, 2025.

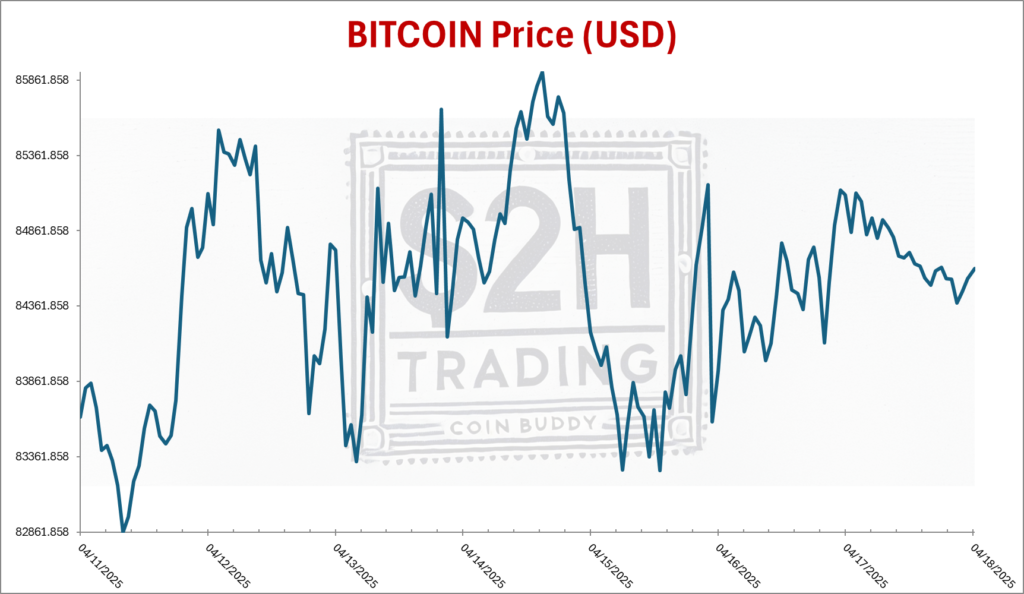

🟠 Bitcoin (BTC)

Price: $84,930.91

Weekly Change: +6.26%

YTD Performance: +38.48%

Technical Analysis

Bitcoin rebounded from a low of $74,508 earlier this week to consolidate above $84,000. The 5-day moving average is at $84,565.23, indicating short-term bullish momentum. However, the 50-day moving average stands at $87,039.13, suggesting potential resistance ahead.

Fundamental Analysis

The recent price recovery coincides with a pause in U.S. tariffs, easing investor concerns. Despite reduced trading volumes, the resilience in Bitcoin’s price suggests growing maturity in the asset class.

Trading Strategy

- Short-Term: Consider buying on dips above the $80,000 support level.

- Medium-Term: Monitor for a breakout above the 50-day moving average to confirm continued bullish momentum.

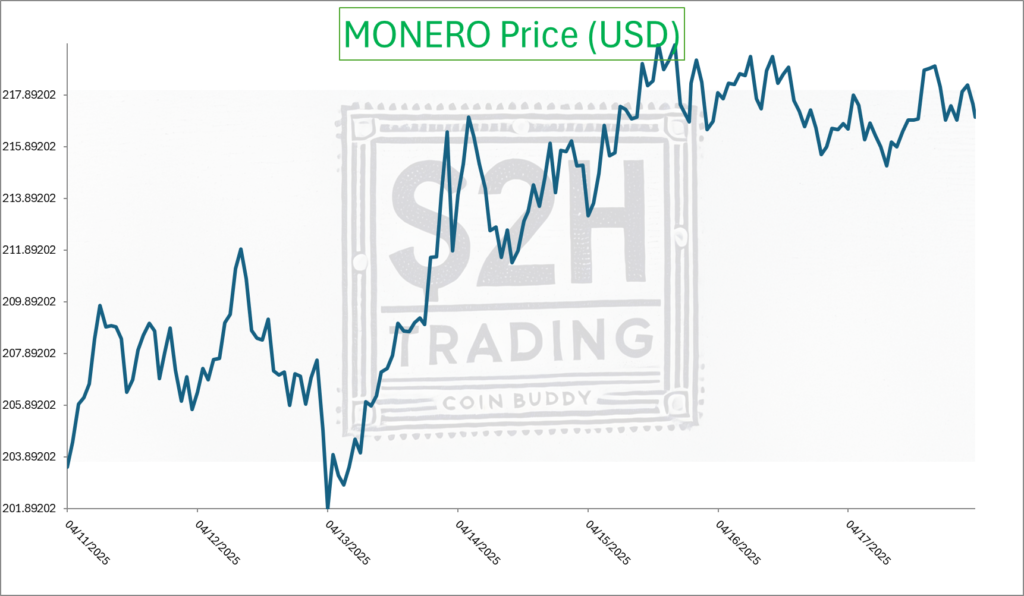

🟣 Monero (XMR)

Price: $216.92

Weekly Change: +8.85%

YTD Performance: +84.88%

Technical Analysis

Monero has broken above the $200 resistance, signaling a potential bullish breakout. The price is currently consolidating between $219.03 and $227.53, indicating a period of accumulation.

Fundamental Analysis

Increased demand for privacy-focused cryptocurrencies and ongoing development in Monero’s protocol are contributing to its positive trajectory.

Trading Strategy

- Short-Term: Look for buying opportunities on pullbacks to the $210–$215 range.

- Medium-Term: Target a move towards $235–$240, with a potential to reach $262.19 by late April.

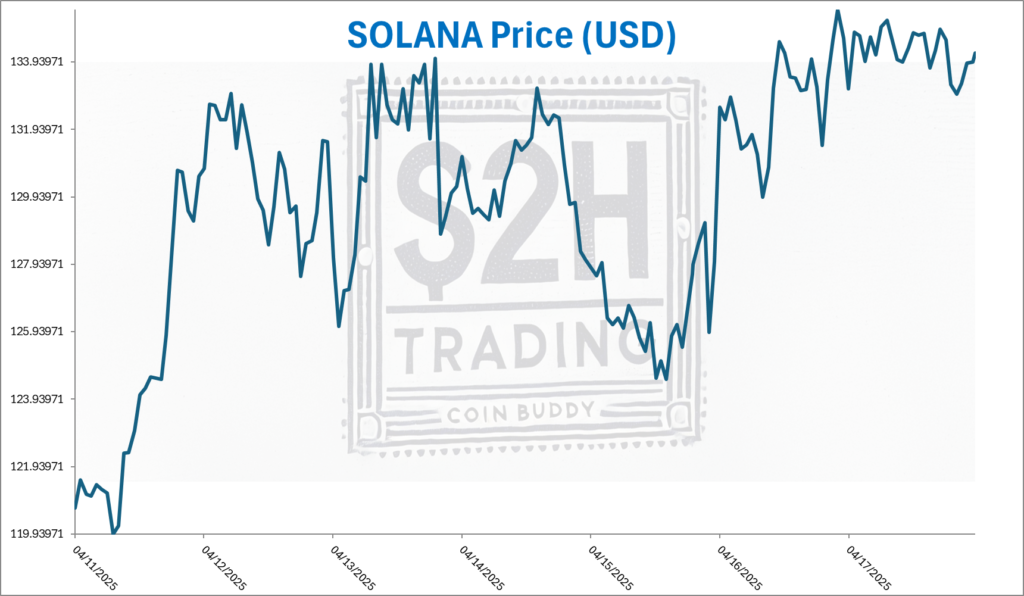

🟩 Solana (SOL)

Price: $134.62

Weekly Change: +13.85%

YTD Performance: +1.57%

Technical Analysis

Solana is trading near its 50-day moving average, a key support level. The RSI has dipped to 45.31, suggesting weakening bullish momentum.

Fundamental Analysis

The approval of a Solana ETF in Canada has sparked increased interest, with spot volumes on platforms like Raydium and Orca surging.

Trading Strategy

- Short-Term: Monitor for a breakout above $147 to confirm bullish continuation.

- Medium-Term: If momentum sustains, target a move towards $200.

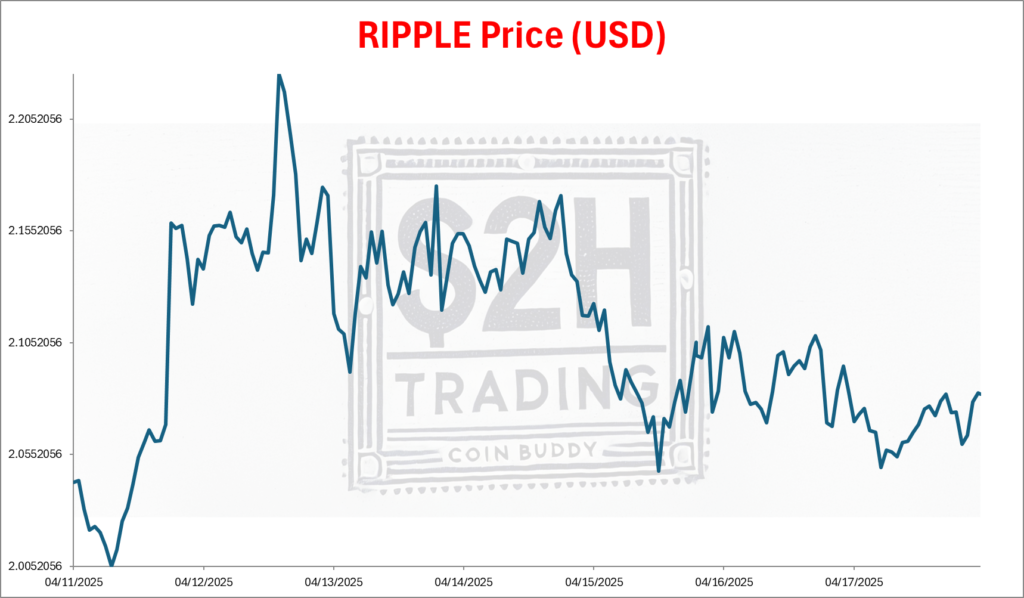

🟦 Ripple (XRP)

Price: $2.08

Weekly Change: +30%

YTD Performance: Data not specified.

Technical Analysis

XRP is consolidating above the $2.00 support level, with resistance at $2.24. A break below $2.00 could lead to a decline towards $1.95 or $1.61.

Fundamental Analysis

Despite ongoing legal challenges, XRP has shown resilience, with a recent recovery from a low of $1.63. Analysts suggest a long-term target between $19 and $45 if bullish momentum continues.

Trading Strategy

- Short-Term: Consider buying near the $2.00 support level, with a stop-loss below $1.95.

- Medium-Term: Watch for a breakout above $2.24 to confirm a bullish trend towards higher targets.

Note: Cryptocurrency investments are subject to high market risks. Please conduct your own research or consult a financial advisor before making investment decisions.