by Scott Emick

4/7/25

As of April 7, 2025, the cryptocurrency market is experiencing significant volatility, influenced by macroeconomic factors and technical indicators. Here’s an updated analysis of Bitcoin (BTC), Monero (XMR), Solana (SOL), and Ripple (XRP), incorporating both technical and fundamental perspectives.

Bitcoin (BTC):

Technical Analysis:

Bitcoin is currently trading at $76,732, reflecting a 7.2% decline from the previous close. The intraday high reached $82,803, with a low of $74,561. The cryptocurrency has recently formed a “death cross,” where the 50-day moving average crosses below the 200-day moving average, often considered a bearish signal. Key support levels to monitor are $74,000, $65,000, and $57,000, while resistance is anticipated around $87,000.

Fundamental Analysis:

The recent downturn is partly attributed to escalating trade tensions following President Donald Trump’s announcement of new tariffs. These developments have heightened market volatility, impacting risk assets like Bitcoin.

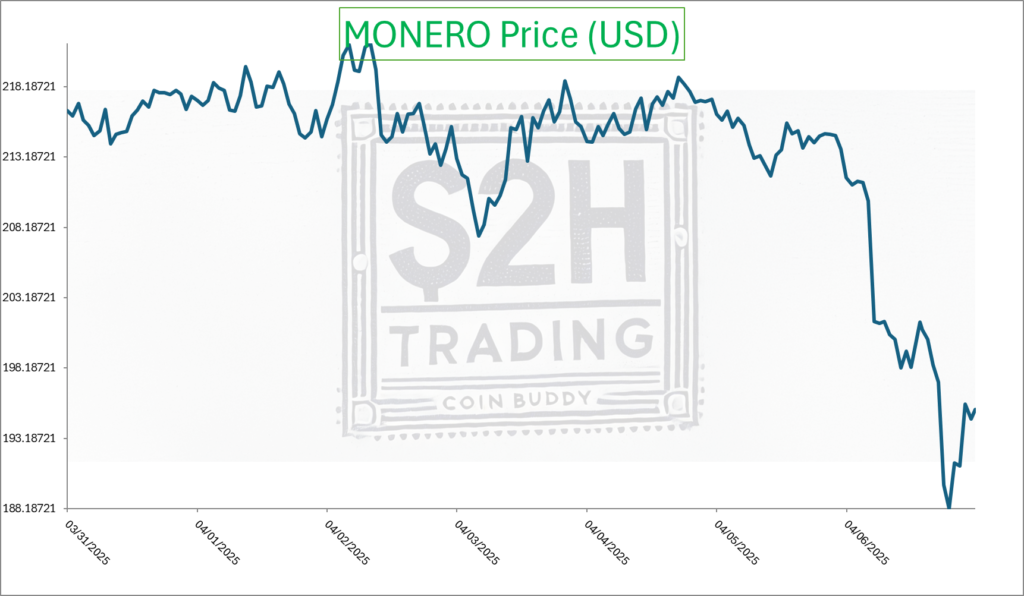

Monero (XMR):

Technical Analysis:

Monero is trading at $194.80, down 8.15% from the previous close. The intraday high was $212.23, and the low was $185.86. The price has fallen below the 50-day moving average, indicating potential bearish momentum.

Fundamental Analysis:

Monero’s emphasis on privacy continues to attract users seeking anonymity. However, regulatory scrutiny of privacy-focused cryptocurrencies remains a concern. Price forecasts suggest potential volatility, with estimates ranging from $200 to $349.94 in the near term.

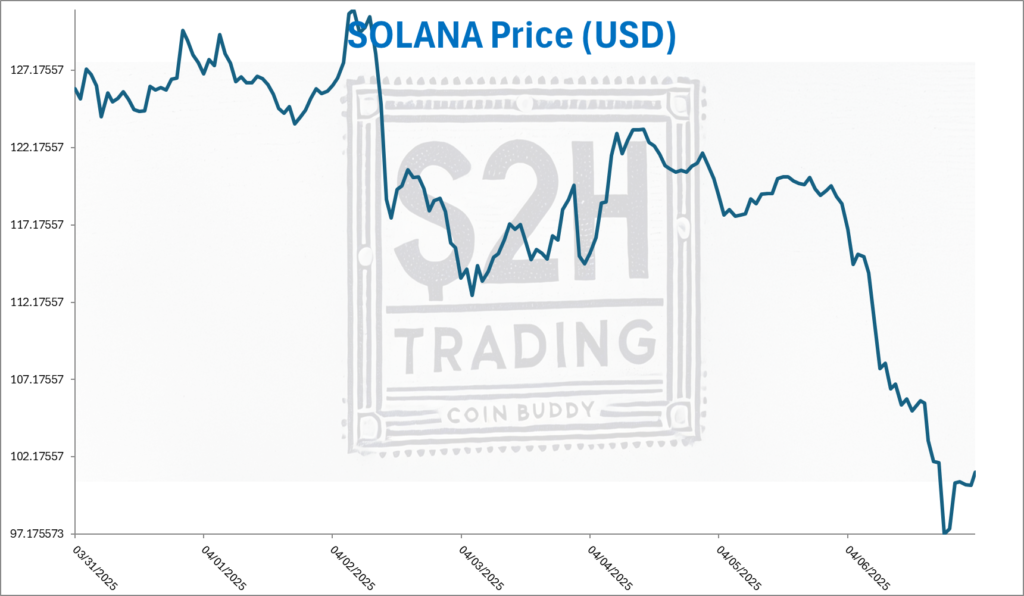

Solana (SOL):

Technical Analysis:

Solana is priced at $101.67, experiencing a 13.26% decline from the previous close. The intraday high reached $117.42, with a low of $96.96. The price has slipped below the critical $100 support level, suggesting further downside potential.

Fundamental Analysis:

Solana faces selling pressure due to an impending token unlock worth approximately $200 million. This event could increase the circulating supply, potentially impacting the price negatively. Additionally, broader market weakness and macroeconomic uncertainties contribute to the current bearish sentiment.

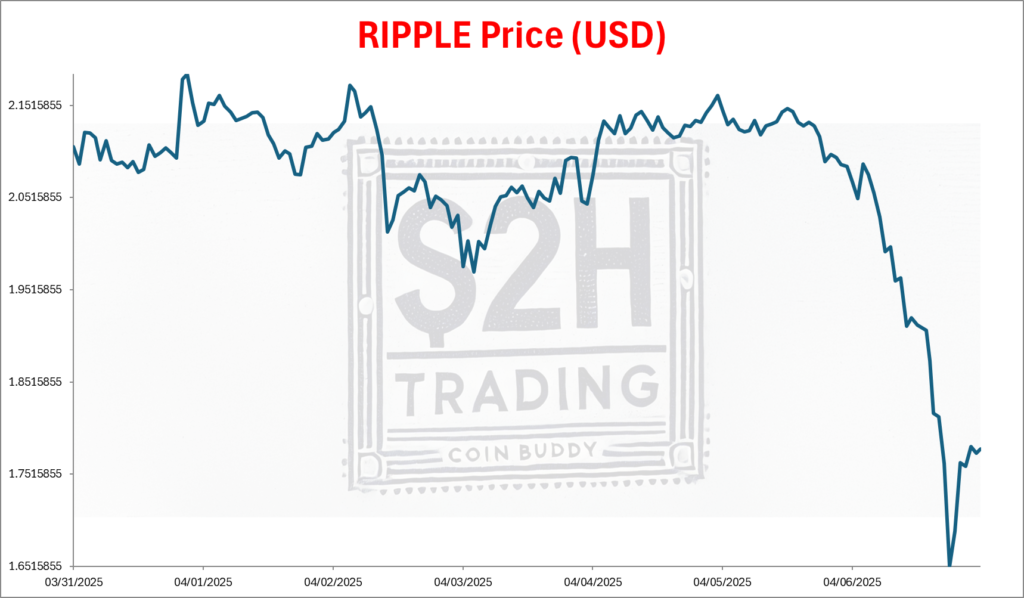

Ripple (XRP):

Technical Analysis:

XRP is trading at $1.78, down 14.01% from the previous close. The intraday high was $2.09, and the low was $1.65. The price has breached key support levels, indicating potential for further declines.

Fundamental Analysis:

XRP’s performance is influenced by ongoing regulatory developments and market sentiment. Despite recent accumulation by long-term holders, the price remains under pressure due to broader market downturns and specific bearish patterns. Analysts have varying predictions, with some forecasting potential price increases contingent on favorable market conditions.

Conclusion:

The cryptocurrency market is currently navigating a complex landscape marked by technical bearish signals and macroeconomic challenges. Investors should exercise caution, monitor key technical levels, and stay informed about ongoing economic and regulatory developments that could impact these digital assets.