by Scott Emick

4/4/1015

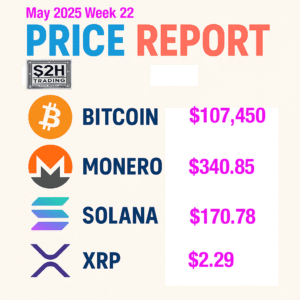

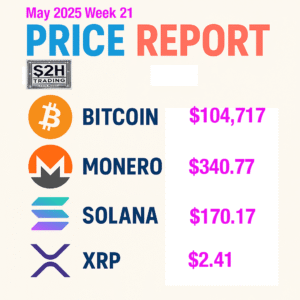

Here’s a comprehensive weekly update on Bitcoin (BTC), Monero (XMR), Solana (SOL), and Ripple (XRP), incorporating both technical and fundamental analyses as of April 4, 2025.

Bitcoin (BTC)

Technical Analysis:

Bitcoin is currently trading at $84,187, reflecting a 2.55% increase from the previous close. The intraday high reached $84,679, with a low of $81,710. The cryptocurrency is approaching a “death cross,” a bearish indicator where the 50-day moving average crosses below the 200-day moving average. This pattern, last observed in August 2024, led to a 16% decline. Analysts are divided on its implications; while some view it as a potential precursor to further losses, others caution that not all death crosses result in significant downturns.

Fundamental Analysis:

Market sentiment is influenced by impending “Liberation Day” tariffs announced by President Donald Trump, set to take effect this week. These tariffs have heightened economic uncertainty, impacting risk assets like Bitcoin. Analysts suggest that softer-than-expected tariff news could trigger a breakout above $88,000, while harsher measures might push prices down to around $73,000.

Monero (XMR)

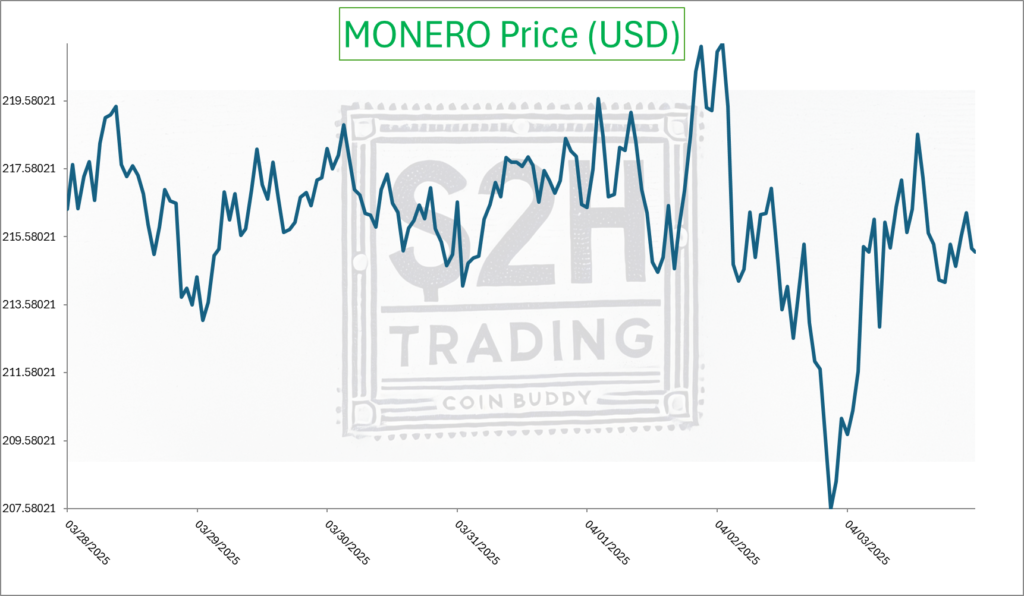

Technical Analysis:

Monero is trading at $214.78, marking a 2.16% rise from the previous close. The intraday high was $218.82, and the low was $209.14. The weekly chart exhibits a bullish engulfing pattern, indicating strong buying momentum. Monero is within a rising trend channel, suggesting continued upward movement.

Fundamental Analysis:

Monero’s focus on privacy continues to attract users prioritizing anonymity. However, regulatory scrutiny of privacy coins poses potential challenges. Experts predict that by the end of 2025, Monero’s price could range from $250 to $345, contingent on market and regulatory developments.

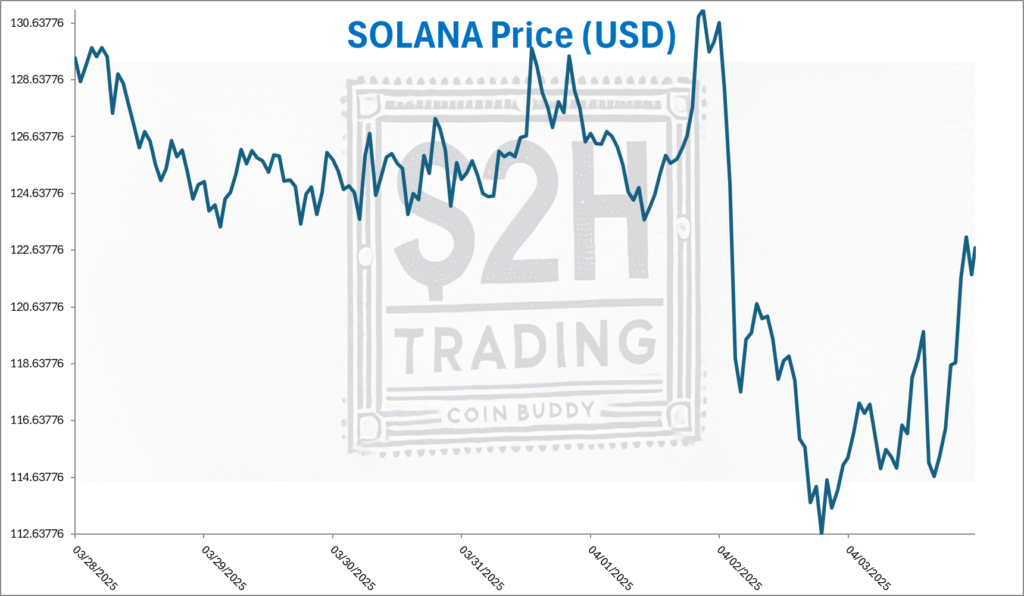

Solana (SOL)

Technical Analysis:

Solana is priced at $122.63, up 6.38% from the previous close. The intraday high reached $123.31, with a low of $113.66. The price is consolidating below $130, with resistance at $138. A breakout above this level could target $165.

Fundamental Analysis:

Solana faces potential selling pressure due to the upcoming unlocking of over $200 million worth of tokens on April 4. This event could influence short-term price movements. However, the network’s robust activity and growing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs) sectors support a positive long-term outlook.

Ripple (XRP)

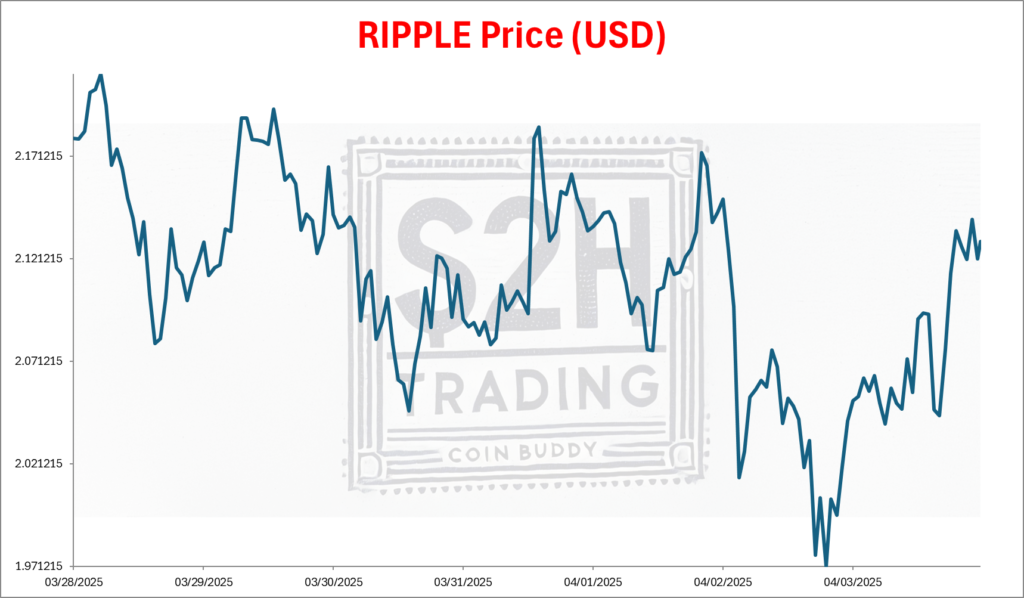

Technical Analysis:

XRP is trading at $2.13, reflecting a 3.90% increase from the previous close. The intraday high was $2.15, and the low was $2.02. The price is oscillating between $1.79 and $3.00, with potential for a 62–70% rally if key technical thresholds are surpassed.

Fundamental Analysis:

XRP’s performance is closely tied to developments in the SEC’s consideration of a spot XRP ETF and Ripple Labs’ business deals. Market sentiment is also affected by broader economic factors, such as the upcoming tariffs. A move above $3 would invalidate the current bearish outlook.

Conclusion:

The cryptocurrency market is currently navigating a complex landscape influenced by technical indicators and macroeconomic factors. Investors should monitor key technical levels and stay informed about regulatory and economic developments that could impact these digital assets.