by Scott Emick

2/23/25

As of February 23, 2025, the cryptocurrency market continues to exhibit dynamic movements influenced by a blend of macroeconomic factors, regulatory developments, and market sentiment. Below is a comprehensive analysis of the current price movements and future projections for Bitcoin (BTC), Monero (XMR), Solana (SOL), and Ripple (XRP).

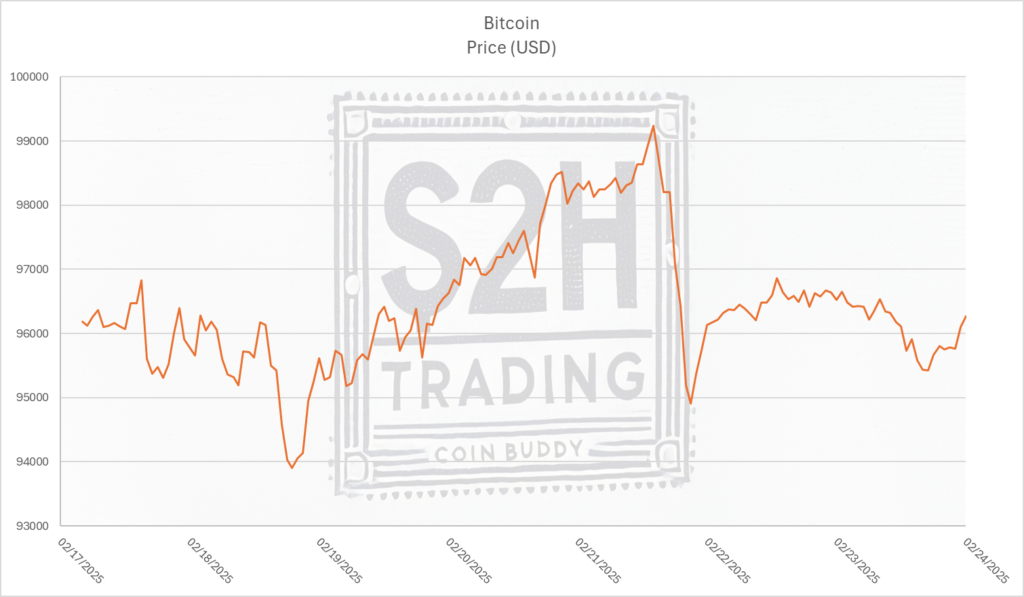

Bitcoin (BTC):

Currently, Bitcoin is trading at $95,591, reflecting a slight decrease of 0.97% from the previous close. The intraday high reached $96,581, with a low of $95,245.

Bitcoin has experienced a remarkable ascent over the past year, surpassing the $100,000 mark in late 2024. This surge is largely attributed to expectations of a more favorable regulatory environment under President Donald Trump’s administration and the introduction of spot exchange-traded funds (ETFs), which have opened the crypto market to institutional investors. Analysts from Galaxy Digital forecast that Bitcoin could reach $150,000 in the first half of 2025 and potentially $185,000 by year-end, driven by increased institutional, corporate, and national adoption.

However, potential volatility remains, influenced by the Federal Reserve’s interest rate decisions and macroeconomic uncertainties. Some analysts caution that Bitcoin could experience corrections, with projections suggesting possible dips to around $85,000 due to market dynamics such as the expiration of significant options contracts.

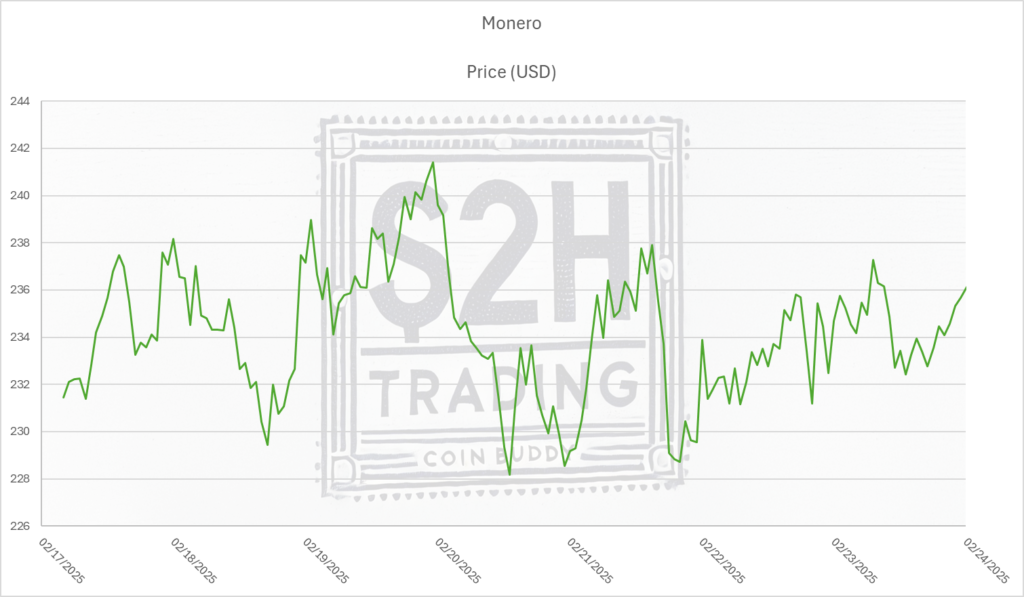

Monero (XMR):

Monero is currently priced at $236.10, marking a modest increase of 0.78% from the previous close. The intraday high stands at $237.77, with a low of $232.15.

As a privacy-focused cryptocurrency, Monero’s price movements are often less correlated with broader market trends and more influenced by developments in privacy technology and regulatory stances on anonymity in digital transactions. While specific short-term price predictions are scarce, the unique value proposition of Monero in offering enhanced privacy features continues to attract a dedicated user base. Investors should monitor regulatory discussions and technological advancements related to privacy coins, as these factors are likely to impact Monero’s future valuation.

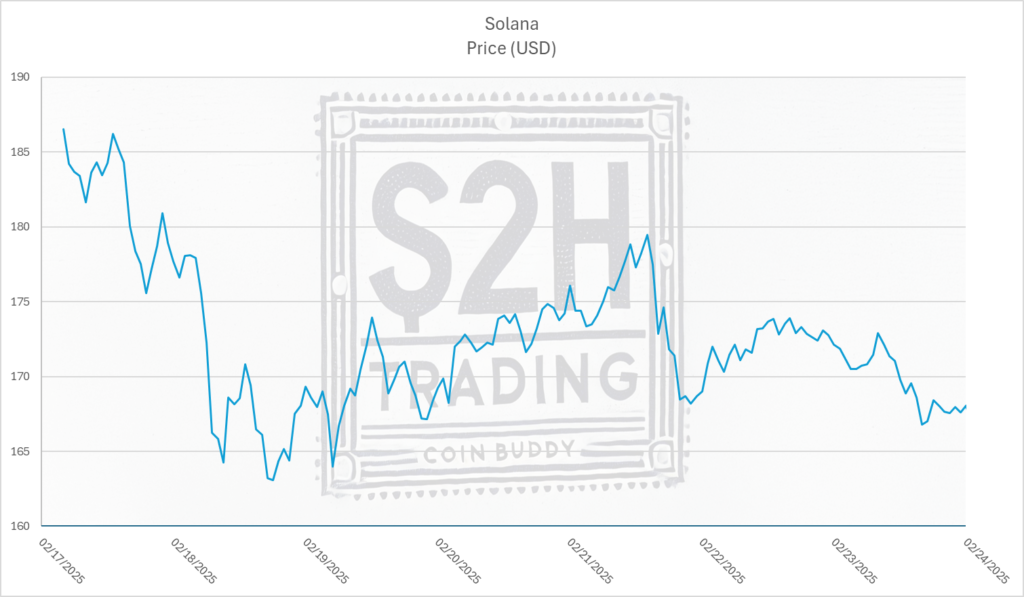

Solana (SOL):

Solana is trading at $161.12, experiencing a decline of 5.63% from the previous close. The day’s high reached $173.03, with a low of $160.85.

Recent price pressure on Solana can be attributed to security concerns, notably the laundering of funds from the Bybit hack through Solana-based memecoins, and the impending unlock of $2 billion in SOL tokens from the FTX estate, which could increase market supply and exert downward pressure on prices.

Despite these challenges, Solana’s fundamentals, including its high transaction speeds and expanding ecosystem, position it well for future growth. Analysts have varied projections, with some forecasting steady growth reaching approximately €523.51 (around $600) by the end of 2025, while others anticipate more conservative increases.

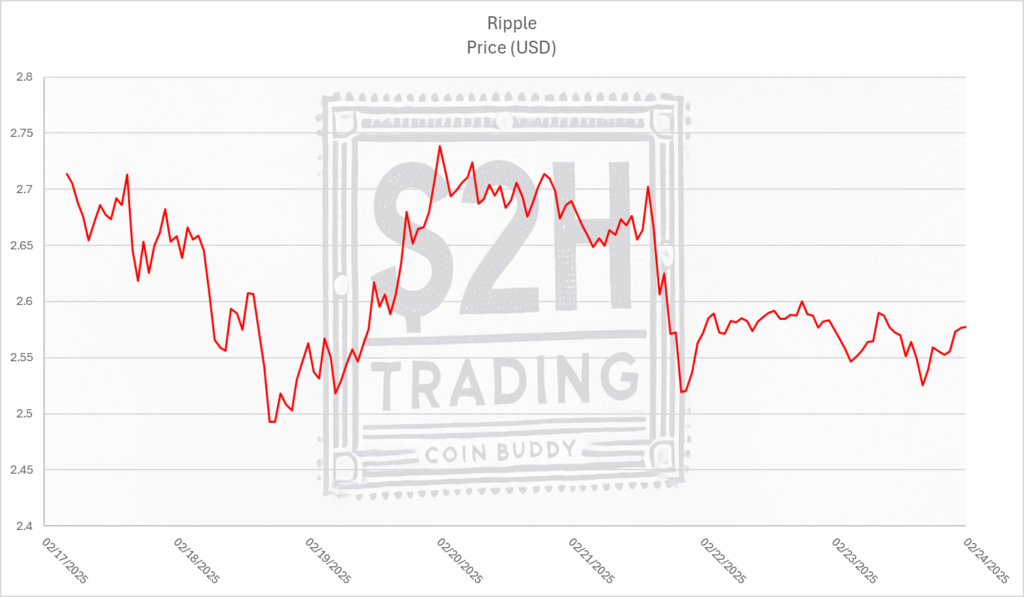

Ripple (XRP):

XRP is currently valued at $2.50, reflecting a decrease of 1.96% from the previous close. The intraday high was $2.60, with a low of $2.50.

The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) continues to influence XRP’s price. A favorable resolution, potentially influenced by recent SEC decisions in other cases, could trigger a significant rally, with prices potentially surpassing $3 and approaching all-time highs.

Long-term projections for XRP vary widely. Some analysts suggest that if XRP were to capture a substantial share of the global crypto market, its market capitalization could reach multi-trillion-dollar levels, translating to prices as high as $27.65 per token. However, such optimistic scenarios are contingent upon widespread adoption and favorable regulatory outcomes.

Conclusion:

The cryptocurrency market remains highly volatile, with prices influenced by a complex interplay of regulatory developments, technological advancements, macroeconomic factors, and market sentiment. Investors should conduct thorough research and consider their risk tolerance before making investment decisions in this dynamic environment.