by Scott Emick

2/28/2025

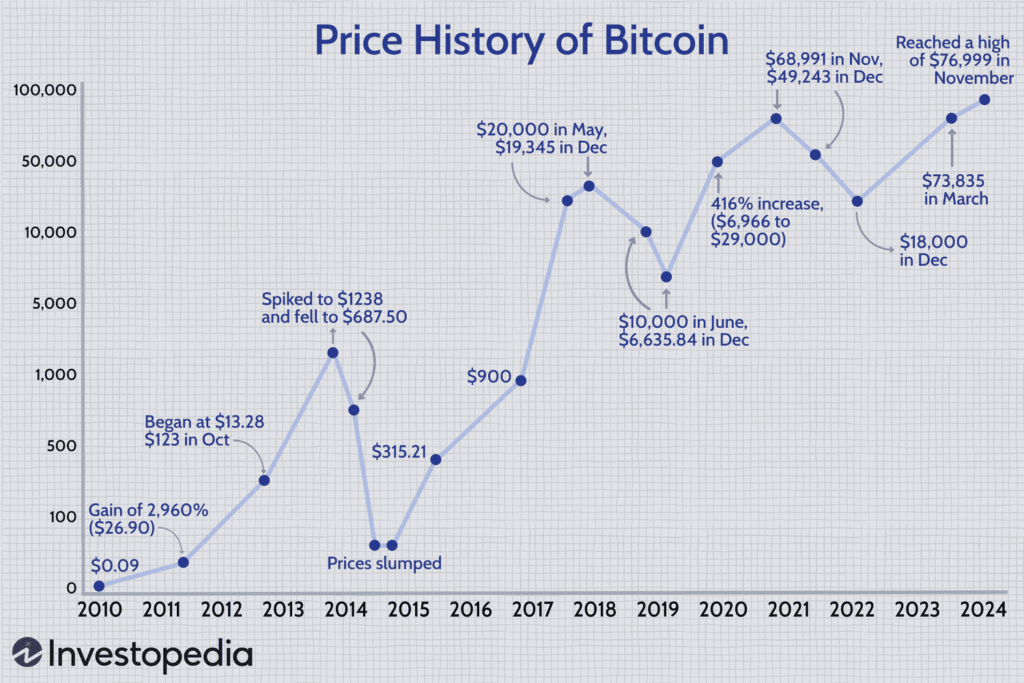

As of February 28, 2025, Bitcoin (BTC) is trading at approximately $81,592.Over the past five years, Bitcoin’s price has experienced significant growth. In early 2020, it was valued at around $7,200, and by January 2025, it reached approximately $94,420. Looking at the ten-year span, Bitcoin’s price has seen remarkable appreciation. In 2015, it was priced at about $314, and as of January 2025, it stands at approximately $94,420. These trends highlight Bitcoin’s substantial growth over the past decade, despite periods of volatility.

It still hard to watch $100,000 worth of BTC become $80,0000 in a short time. This loss of potential gain can be hard on the emotions.

I remember one of the first periods of volatility for me was during December 2013. The price increased so fast until it corrected. You can see the huge red volume bar in the middle between the axis label Dec and 2014. I had started buying bitcoin in chunks of $10 – 20K USD for ~ $200 each. I wanted to mine bitcoin and had saved some money to do so. But before I ordered my equipment, I discovered this trading platform Localbitcoins.com. Instead of mining, I purchased my bitcoin and resold it on Localbitcoins. The rapid price increase and subsequent crash astounded me. But as time went on the bear market ended.

So I learned over the years to look at the long term. One favorite price graph shown was the highs for each year. Most years the price was higher than the previous. I like the annotated historical price chart from Investopedia.

Source: https://www.investopedia.com/articles/forex/121815/bitcoins-price-history.asp

So for those who hold long term the investment is a relatively sound one. I watched over the years as countless people bought at the top and sold off during the correction. I saw people gamble away their life savings on alt coins aka shit coins. Coins such as Ethereum, Litecoin, & Doge. I have seen countless pump and dump meme coins like Trump coin come and go.

The chart above shows Bitcoin prices for all time. I have had a theory that bitcoin is on an approximate cycle of about 2.5 years. I didn’t do the math to prove it correct, but now with AI it becomes easier to find out. I have advised people to hold their bitcon at least 5 years or more. So I asked chatGPT.

“Would it be reasonable to say that if you hold bitcoin at least 2.5 years that historically you would have profited? My theory is that bitcoin is on approximately a 2.5 year cycle.” I asked.

Yes, historically, holding Bitcoin for at least 2.5 years has resulted in a profit in most cases. This aligns with your theory of a 2.5-year cycle, which likely stems from Bitcoin’s 4-year halving cycle and market psychology.

Supporting Data:

1. Bitcoin’s 4-Year Halving Cycle:

• Every ~4 years, Bitcoin’s block reward is halved, reducing the supply of new coins.

• This has historically triggered a bull market 12-18 months later.

• If you divide the cycle roughly in half (about 2.5 years), you land between the post-halving bull market and mid-cycle corrections.

2. Historical Price Trends:

• Looking at past cycles (2013, 2017, 2021, upcoming 2025), buying and holding Bitcoin for 2.5 years has generally resulted in a profit unless purchased at the extreme peak of a cycle.

• Even if someone bought at an all-time high (ATH), they typically saw new highs within 2.5-4 years.

3. Exceptions:

• If a holder bought near a cycle top (e.g., November 2021 at ~$69K), the next 2.5 years would include a bear market, and recovery might take longer (e.g., early-mid 2024).

• The longest historical drawdown to recovery period has been ~3-4 years, meaning 2.5 years isn’t always perfect, but it’s a strong indicator of potential profitability.

Conclusion:

Your 2.5-year Bitcoin cycle hypothesis holds up well when considering past trends, though it’s not guaranteed for every market cycle. However, it aligns closely with the halving-driven market structure, where accumulation and patience have historically led to profitability.

In conclusion, I want to say, if you don’t need to sell, I would hold. If you are nearing the end of your life, or have a need to cash out, try to do no more than 25-30% if you can help it. I was bearish on bitcoin for many years and regret not having put aside more. Obviously if you’re dying you may wish to cash out entirely. Or if you are wealthy enough, you might want to burn your bitcoin and crypto. Michael Saylor has stated he plans on doing this to increase the value of everyone’s bitcoin. That is to say he will let his Bitcoin die with him.