by Scott Emick

1/14/25

Cryptocurrency prices have experienced a notable recovery since yesterday, influenced by several key factors:

1. Political Developments: The election of President Donald Trump has significantly impacted the crypto market. His administration’s pro-crypto stance, including promises to ease regulations and integrate cryptocurrency into mainstream finance, has boosted investor confidence. Notably, Trump’s appointment of crypto-friendly officials and plans to establish a national Bitcoin reserve have further fueled optimism.

2. Institutional Investment: Major institutional players have increased their cryptocurrency holdings, signaling strong market confidence. For instance, MicroStrategy recently purchased 2,530 Bitcoins for $243 million, bringing its total holdings to approximately 450,000 tokens, valued at $43.35 billion.

3. Market Sentiment: The Crypto Market Sentiment Index has risen to 63, indicating a shift towards a more greed-based sentiment. This change suggests that investors are becoming more optimistic about the market’s future performance.

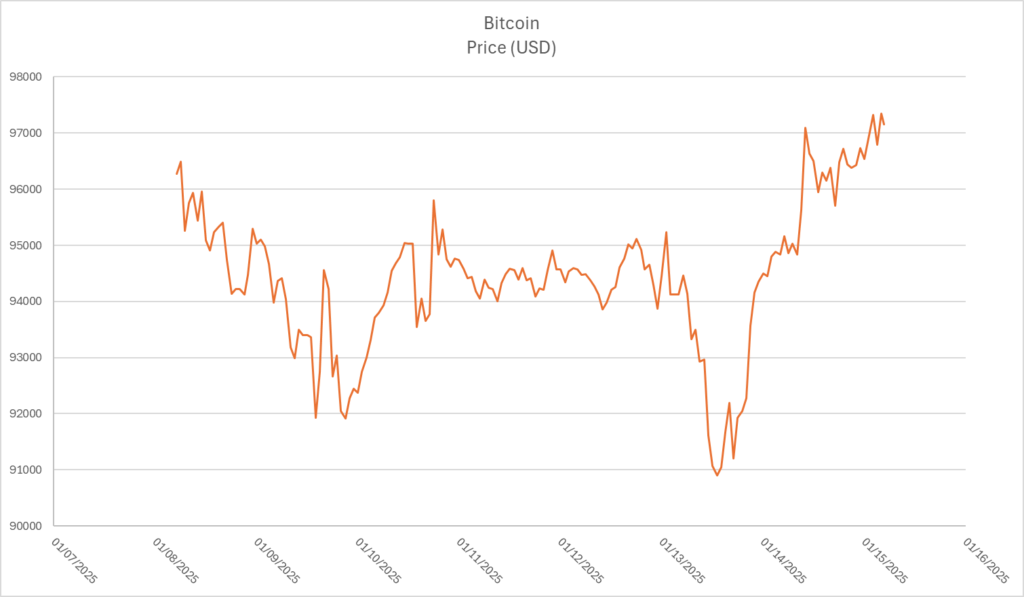

4. Technical Factors: Bitcoin’s recent price movements have alleviated bear-market fears. Analysts note that as long as Bitcoin remains above certain support levels, the market may continue its upward trend.

5. Broader Economic Indicators: The correlation between Bitcoin and U.S. equities has grown, with rising Treasury yields impacting both assets. This relationship suggests that broader economic factors are influencing cryptocurrency prices.

These combined factors have contributed to the recent recovery in cryptocurrency prices observed since yesterday.